Here list of the best entertainment mobile apps that you should try on your device.

Budget apps help you to understand your income and spending in much greater detail so that you have effective control over your money.

There are different kinds of budget apps, some of which can be easily connected to your bank account and credit cards, which can get information regarding your transactions and then segment them into various domains to match it with your earnings.

Some of the top budget apps are extremely easy to use, are highly affordable, and come with features that you need. Here we have put together a list of top budget apps that are available in the market.

YNAB

This is one of the popular budgeting apps that you will find online. This app offers you a 34-day free trial offer and if you like it then you have to pay a subscription of $ 84 per annum or $ 11.99 per month to use it. You can sync this app with your bank accounts to import all the transaction details and then categorize them. You can also enter your transactions manually. To ensure the security of your data, this app provides you with bank-level encryption, third-party audits, and password security.

Key Features of YNAB Mobile App

- Free 34 days trial for you to check whether it is ideal for your needs.

- Bank-level encryption makes it a great payment gateway.

- Good customer service for an amazing experience.

- Goal tracking to meet your financial goals.

- Real-time expense tracking for accurate budgeting.

Goodbudget: Budget & Finance

This app is excellent to manage your finances as well as keeping track of your earlier transactions. It is founded on the envelope budgeting system, in which multiple portions of your monthly income are directed towards different spending categories (also called envelopes). It has a free version, but if you want to use all the premium features of this app, then you have to pay $ 7 per month or $ 60 per year a subscription fee.

Key Features of Goodbudget Mobile App

- Supports multiple devices for you to access from anywhere.

- It is affordable so anyone can use it to meet their financial goals.

- Supports multiple users that allow the partners to keep track of their overall expenses independently.

- Split expense transactions for better budgeting.

- Insightful reports for better money management.

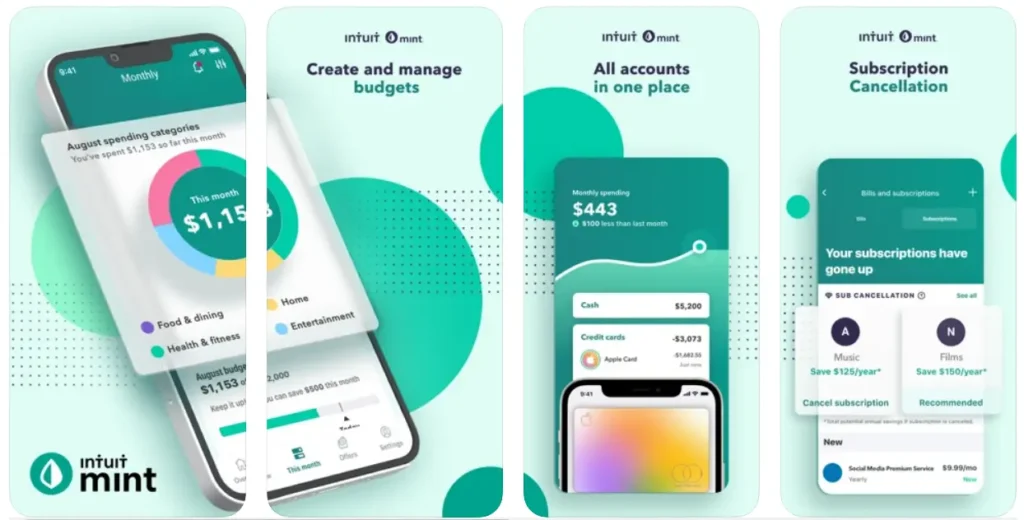

Mint

This is a very powerful budgeting app that is available for free. It is a fantastic option for someone who is looking to manage his/her spending habits. If you want, you can sync your bank account with this app to retrieve your cash balance and spending transactions. You can also manually add these transactions to your app for better management of your money. This app divides your spending into multiple categories and you can look at the spending of each category which helps you to understand any rise or fall in your spending pattern at a glance.

Key Features of Mint Mobile App

- Great security features that allow you to use it with complete peace of mind.

- Investment tracking to keep track of your investment goals.

- Completely free for anyone who is interested in managing his/her finances.

- All your money in one app to track your money spending.

- Support cryptocurrencies for an all-inclusive financial management solution.

Simplifi

This is another popular budgeting app that has very powerful tracking capabilities of your expenses inbuilt into it.

This app gives you clear guidelines about how much you can afford to spend based on what you are earning. It comes with a 30-day trial and after which you have to pay $ 3.99 per month or $ 35.99 per year to use it.

This app also allows you to connect all your bank accounts so that you get a bird’ eye view of all your finances and then automatically put your expenses under various heads for easy understanding.

It also has a custom watchlist special feature that allows you to limit how much money you spend on a specific category or even payee.

Key Features of Simplifi Mobile App

- Highly secure and can be used with complete peace of mind.

- Watchlist for prudent spending to ensure that you don’t overspend.

- Multiple cash flow tools to keep track of your finances.

- Customized saving insights to meet your financial goals.

- Track your spending to check where you are spending more.

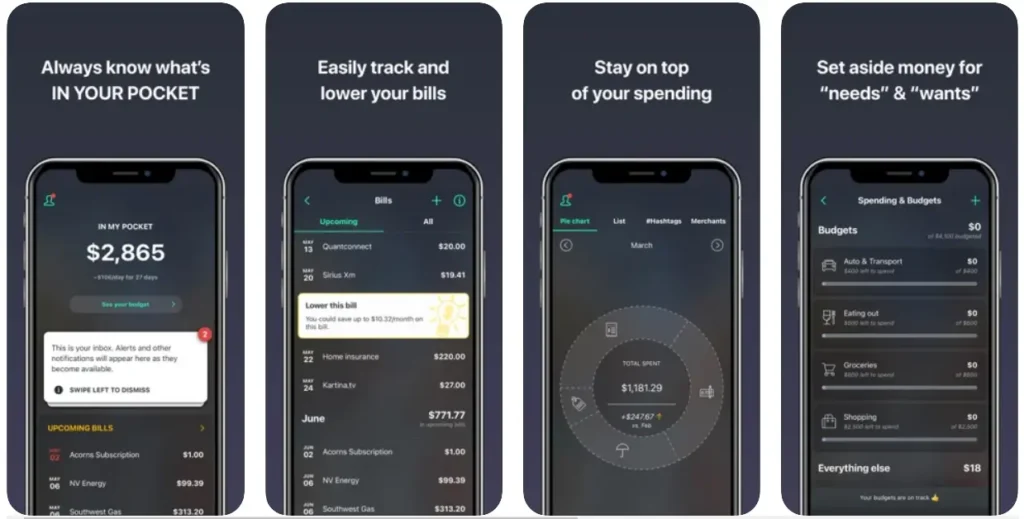

PocketGuard

This is a very simple app to use for keeping track of your revenue and expenditure. You can easily connect this app with your bank accounts, investment portfolio, and credit cards to get complete information on all your expenses and liabilities in one place. By using all this information, the app will give you a complete picture of how much money you can save after you have met all your expenses. You can also put the information manually. It has a free and paid version. In the paid version there are some additional features like the option to export your transactions, debt payoff plans, and many more.

Key Features of PocketGuard Mobile App

- Very easy to use by anyone even with little technical expertise.

- Great analytics gives you a complete picture at a glance.

- Free and paid versions for your differentiated needs.

- Investment tracking to keep track of your investment goals.

- Good customer service for an amazing experience.

Personal Capital

This is one of the top budgeting apps that you can use to manage your money. It has an easy-to-read dashboard through which you can sync all your bank accounts to get a 360° view of your finances. While the basic version of the app is free, if you want to get some additional features, then you have to pay a fixed percentage of your investment through this app. It has several tools that give you a complete view of all your expenses every month, and you can also look at your spending based on various categories. This app comes with multiple investment tools through which you can plan for your future. Some of these tools include daily capital, education planner tool, personal capital’s blog et cetera.

Key Features of Personal Capital Mobile App

- Multiple investment tools for wider choices.

- Network tracking for real-time spending analysis.

- Free analyzer tool to manage your portfolio.

- Plan long-term investments for a happy and stress-free retirement life.

- Manage all accounts for seamless financial management.

Conclusion

It is not easy to rank budgeting apps as the requirement for different users may vary significantly. Therefore, if you want to find the best budget app that is perfect for your needs, then you have to take a look at all the apps that we have listed to find one which has all the features that you require and also has a very low cost to sign up.

Comments